In How my journey into Crypto world started I discussed how I got started investing and getting involved in cryptocurrencies, initially as a side effect of starting to use the Brave Browser and generating a small passive income based on Brave Rewards.

I also discussed how I started experimenting and using a few applications within cryptocurrency. However, this really is only the very beginning of journey, just the few tender steps into this new world. I was completely unprepared for what was to come later, which is what I will attempt to cover in this post.

Down the Rabbit hole

The term down the rabbit hole is a metaphor for the entry into the unknown, which is what happens in Alice in Wonderland. The rabbit hole is the place where everything begins and the rabbit hole symbolises a gate into a new world, adventures, and unknown territories.

It's a phrase you will get to hear quite often among crypto community, because as you will undoubtedly you'll start to question everything you think you know about the world, i.e. Economics, Politics, Money, History, Technology, Trade and communities.

I have to admit, I have always been what David Graeber, refers to as anarchist, the small a is intentional, because the belief system is somewhat different to Anarchy.

anarchism is about creating and enacting horizontal networks instead of top-down structures like states, parties or corporations; networks based on principles of decentralized, non-hierarchical consensus democracy.

David Graeber

I also firmly believe that there is no particular set of social conditions needed for social revolution; we just have to start and dare the state to stop us. I firmly believe that Cryptocurrencies may provide the opportunity for everyone to start from the same point. This is one of the first concepts, that most people coming into the Cryptocurrency space struggle with at first.

Quite often people enter the Cryptocurrency and Bitcoin space, based purely on the belief that it is an easy way to generate wealth or a get rich quick scheme. Although one of those could be true, it should never be the primary reason.

Come for the price, stay for the revolution

Mark Moss

In order to understand Cryptocurrencies, you first really have to understand money. We all think we understand money, for the most part we've grown up with it and use it everyday, but we don't really understand it. It's just something that is part and parcel of our everyday lives, a vast majority of us on the planet today spend our lives in pursuit of it and for what we believe money will provide, but we don't actually understand it.

In my opinion, one of the best books to read to start gaining a basic understand of money is Debt : The first 5000 years, primarily because in order to understand our current system of FIAT or Faith based currencies, we have to understand the Human relationship with Debt.

David Graeber

Before there was money, there was debt. For more than 5,000 years, since the beginnings of the first agrarian empires, humans have used elaborate credit systems to buy and sell goods—that is, long before the invention of coins or cash. It is in this era that we also first encounter a society divided into debtors and creditors—which lives on in full force to this day.

Buy Now Read ReviewWhat is FIAT Money?

FIAT money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it. Most modern paper currencies are fiat currencies, including the U.S. dollar, British Pound, the euro, and other major global currencies.

In a vast majority of cases, FIAT money is only backed by capability of the Government that issued it to repay its debt, and nothing more. The paper money, that we hold in our wallets are nothing more than an elaborate IOU note. In fact, you can think of our entire supposed economic system being one big giant circle-jerk of credit.

It is on this note that we can lean on another one of David Graebers book, Bullshit Jobs - The rise of pointless work and what we can do about it. In this book, we learn that the apparent much respected and often cited economist, John Maynard Keynes, predicted that by the year 2000 technology would have advanced sufficiently that countries like Great Britain and USA would have achieved the 15 Hour work week, but yet here we are apparently working harder than ever, despite the fact that most productive jobs have been largely automated away.

We now live in a time, that the primary purpose of our supposed education system, is to enslave the younger generation as early as possible by ensuring that they join the workforce so far in debt that they have to work at least 20 years before they are able to pay off their education fees. Which is ironic because the primary reason why we want to educate our young to the supposed highest standard we can, is so that they can get better jobs, for the primary reason for paying more in tax, so that they are able to pay off the debts incurred by previous government regimes.

The young have no more prospect of achieving the 15 hour work week, than those that were young in the 1960's. In fact the kids that we are preparing to join the workforce today, can expect to only be able to retire from the workforce at 80. Primarily because of the continual failure of pension funds and the failed economic experiment of inflation.

Failing Democracies

Our political systems are also completely failing, which has become increasingly evident in both the UK and USA. Over the past two decades, democracy has been deteriorating within the two supposed bastions of democracy in the western world, and the quality of the supposed leaders that have been elected has been totally atrocious.

The gradual decay of democracy and evolution of authoritarianism has undoubtedly begun. USA had a narrow escape from one of the most incompetent forms of Authoritarianism, after 5 crazed years of the Ginger Orange mess, to only slip into another strange mess socialist Authoritarianism.

The UK, has not fared any better, having to deal with our very own brand of incompetent form of Authoritarianism.

It speaks volumes that if these supposed leaders of the free world is the best we got, then we are only left to conclude that depth of our gene pool for political talent is extremely shallow and we must be on the cusp of a drought.

I'm picking on these two countries in particular, primarily because they are two countries that I am most familiar with. However, I have to say, from what I have seen from other countries, the situation appears to be familiar.

History has shown that vast inequalities of wealth, institutions like slavery, debt peonage, or wage labour can only exist if backed up by armies, prisons and police.

David Graeber

The Democracy Project

The Democracy Project is an exploration of anti-capitalist dissent and new political ideas from David Graeber, author of Debt: The First 5,000 Years and a leading member of the Occupy movement.

Money printer go Brrrrr

All three books I reference above were all written and published around a very poignant time in our modern history, circa the Financial crisis of 2007-2008, a severe worldwide economic crisis, the most serious financial crisis since the Great Depression. Caused mainly by predatory lending targeting low-income home-buyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminating in a "perfect storm."

Mortgage-backed securities tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

It is also important to note, that these markets were also supposed to be highly regulated and approved the nation state and it's affiliated regulatory bodies. Essentially the crux of the financial crisis is that some people got greedy, took on too much risk, were able to manipulate the financial system to their advantage, and in the end didn’t face the consequences of their actions.

It was also the time when our political classes chose the method of getting out of the severe economic mess created by FIAT currency based on nothing more than the shared belief that a piece of paper has value, is by printing more pieces of paper based on the shared belief that the pieces of paper will have value. The best part is they didn't even print the pieces of paper, because there was no need too, because the amounts they needed to print was so vast, it was just easier to update numbers on a computer screens.

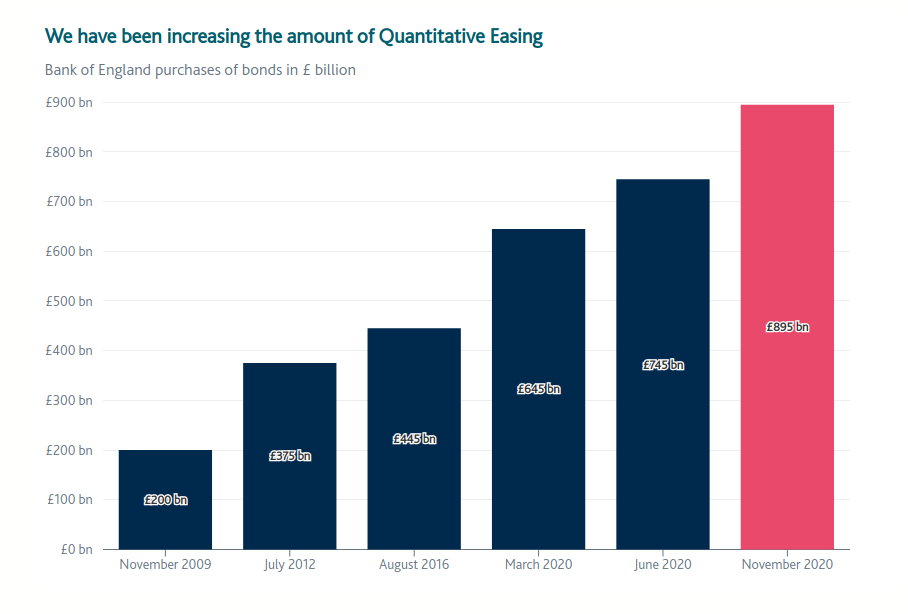

We were all sold the notion of Quantitive Easing, whereby the Central banks by Government and Corporate bonds from other financial companies and Pension Funds. These measures were supposed to help ease the debt markets.

Quantitive Easing, is a process where a central bank, Bank of England, increases the money supply. They literally create more money, out of thin air, and the way they then get it into the economy is by buying government debt with it.

It’s worth reflecting on this. The government can get into as much debt as it likes, spend on whatever it likes, and then the Bank of England can simply create new money to write off that debt.

It is poignant to note that the first transactions in the bitcoin ledger contains the reference The first block of transactions contains the reference “The Times 03/Jan/2009 Chancellor on brink of second bailout for banksâ€.

it's safe to say, that there is an abundance of proof to confirm that the so called economic system that we all think we know and apparently value. is at its core fundamentally broken and for the most part has always been.

I would like to say, that I am not in anyway naive enough to the think that the Cryptocurrency system is the answer we've all been searching for. I may not be, but what it may be is a sign post or at least an introduction to a better alternative.

I've worked in the IT and software development sector for 25+ years and I know all too well that the vast majority of IT projects fail and its a track record that despite our best efforts never seems to improve. However, it never stops us from trying to innovate and improve.

Probably the number one reason why most IT projects fail, hardly ever comes down to the technology or project management etc. Fundamentally, when you analyse it, they predominantly fail because what they succeed at is implementing broken business systems and processes in new technology or just fail in new ways.

We in the IT industry have been selling myths that we work to improve efficiency, drive productivity, reduce waste and maximise profits. Honestly, if I had a satoshi for every time I've heard or read that drivel I'd be be a full coiner by now.

The reality is in the vast majority of cases, it usually turns out the complete opposite. Yet, if you read the LinkedIn profiles of the vast majority of the IT professional profiles one would think completely the opposite. Everyone is amazing and the delivery of all IT projects are delivered on time and within budget. But I digress.

All IT projects ever try to do, is to deliver the same system in a new way. Nobody ever stops to think or to check if the actual system or process is broken. I've also experienced this in Business systems.

I once worked for an organisation, where I sat at the same desk and never moved for 3 years. Yet my job title, job description, department, division, bosses and even company changed multiple times along with the scope of the project. Yet when I left, nothing had fundamentally changed. I read the profiles of the CEOs that came and went during that time and they all claimed how they had revolutionised the business under their tenure. All they did was tinker, because they were paid to tinker.

This where I stumbled on one of the greatest revelations of not only my business life but life in general. Many mistake that the primary things that make us humans unique and separate us from the other species on the planet, is our supposed superior intelligence and our capability to communicate, I have come to the realisation that this is incorrect because its actually our unique ability to bullshit ourselves coupled with the believing our own bullshit.

Nothing highlights this more than our current financial and economic system. We want to believe there is value in money therefore there is value in money. It is this point, that Noah Yuval Harari asserts in Sapiens : A Brief History of Humankind, (which I have read but have not reviewed).

The Bitcoin Standard also discusses this in more depth in the first 3 chapters,

The Bitcoin Standard

The Decentralized Alternative to Central Banking

The Bitcoin Standard analyses the historical context to the rise of Bitcoin, the economic properties that have allowed it to grow quickly, and its likely economic, political, and social implications

Learning from failed projects

one of the software development projects I have had the privilege of learning from, happens to be a project during the great credit crunch. In 2009, I got a contract working for HM Treasury on the initiation of Asset-backed Securities Guarantee Scheme. Basically this was a project to prop up the banks who were the most distressed at the time. Lloyds Bank, RBS, Blackrock and several others.

The most alarming thing I learned first hand back then, is when the treasury asked the banks at the time, just how much money they needed, the banks politely informed them, that they literally had no clue. Primarily because as it is now well documented and in the general public domain, most of the debt was wrapped up in what is known as Derivatives.

Derivatives are secondary securities whose value is solely based on the value of the primary security that they are linked to–called the underlying. Typically, derivatives are considered advanced investing. The reality is they are so advanced that nobody truly knows what is in them.

One of the primary reasons why the Software Development side of the project failed, is that when the banks were asked to submit the data that helped define the investment, the actual data was kept in several thousand different systems in thousands of different formats. As more and more questions were being asked of the banks to supply all the data about how the investments, they all started to withdraw from the scheme.

A few years later, I joined a small RegTech start-up company, who were eventually bought out by the DBG (Deutsche Borse Group) otherwise known as the German Stock Exchange and the main purpose of the system we were developing a system to help Financial institutions comply with European Market infrastructure Regulation (EMIR), to increase the transparency of the over the counter (OTC) derivatives market, so that the EU with the help of European Securities and Markets Authority (ESMA) to have a clear view about the turnover, participants and any possible market manipulation. Another objective is to reduce the number of the counterparties involved and reduce the operational risk for market participants.

The thing I learned, is that the derivatives market, is what makes the world go round. Everything you'll invest in in the market i.e. Real Estate, Pension Funds, Stocks, Bonds, etc, will all in some way be entangled in the derivatives market.

The other thing I learned from these projects, is that Regulations simply don't work. Primarily because greed and corruption trumps everything. Regulations and the efforts that go into them, are nothing more a ruse that the so called political classes to show the public that they are doing something, but in fact all they are actually doing is tinkering around the edges of the actual problems.

Learn before you jump

There temptation to jump straight into cryptocurrency is huge, especially when most of what you hear is people make huge returns and the price of Bitcoin seems to be forever increasing. I get it, but I urge you take some caution before jumping into buying, there is quite a bit to learn and it is well worth remembering the worn out phrase of the traditional investment markets

investments can go up and down in value, so you could get back less than you put in.

There is also a lot of misinformation and bullshit about Cryptocurrencies on both sides of the debate. I have taken the time to learn from both sides. I would urge you to do the same.

As I have mentioned before, I haven't gone all in on crypto, in fact truth be told, crypto is still only makes up about 10 - 15% of my current investment portfolio I am likely to expand this proportion over time, as I learn more and get more comfortable with it. However, there is also the possibility that I may reduce my exposure too. In my opinion this is a sensible approach.

Only with such an understanding, and only after extensive and thorough research into the practical operational aspects of owning and storing bitcoins, should anyone consider holding value in Bitcoin.

Saifedean Ammous - The Bitcoin Standard

- What is this Directory.Packages.props file all about? - January 25, 2024

- How to add Tailwind CSS to Blazor website - November 20, 2023

- How to deploy a Blazor site to Netlify - November 17, 2023